Owning a home is a dream for many, and securing a home loan is often a necessary step in that journey. After much consideration, I opted for Aadhar Housing Finance Ltd (AHFL) to finance my home.

Initially, I had high hopes, but my experience turned out to be far from seamless. Here’s a breakdown of the challenges I faced while dealing with AHFL.

Few variables:

- Loan Amount : Rs. 20,00,000

- Rate of Interest (ROI) : 10.75% (Very high)

- Tenure : 20 Years

- Location & Branch : Govindpuri, New Delhi

Slow Branch Processing

One of the first hurdles I encountered was the inefficiency at the branch level. Whether it was submitting documents, requesting a statement, or even general inquiries, the branch took an unnecessarily long time to process requests. It often felt like my concerns were being shuffled from one desk to another without any concrete resolution.

Customer Care Woes

The customer care service proved to be another major disappointment. Each time I called, I had to go through a long verification process, only to receive vague or unhelpful answers. Their responses lacked clarity, and most of the time, they just redirected me back to the branch, where I had already faced delays.

No Online Pre-Payment or Part-Payment Options

In an era where digital banking is the norm, I was shocked to find that AHFL does not provide an option to pre-pay or make part payments online. Every time I wanted to make an additional payment towards my loan, I had to physically visit the branch. This lack of convenience added unnecessary hassle and made the repayment process far more tedious than it should have been.

Hidden Charges and Lack of Transparency

AHFL boasts about transparency, but my experience was quite the opposite.

- Paid Statements: Unlike most other banks and financial institutions that provide loan statements for free, AHFL charged me for even a basic loan statement.

- Multiple Charges for a Single Request: When I needed a foreclosure letter and a list of documents (LOD), I filled out a single form with checkboxes for both. However, instead of processing it as a single request, they forced me to submit two separate forms, each costing ₹500 + 18% GST.

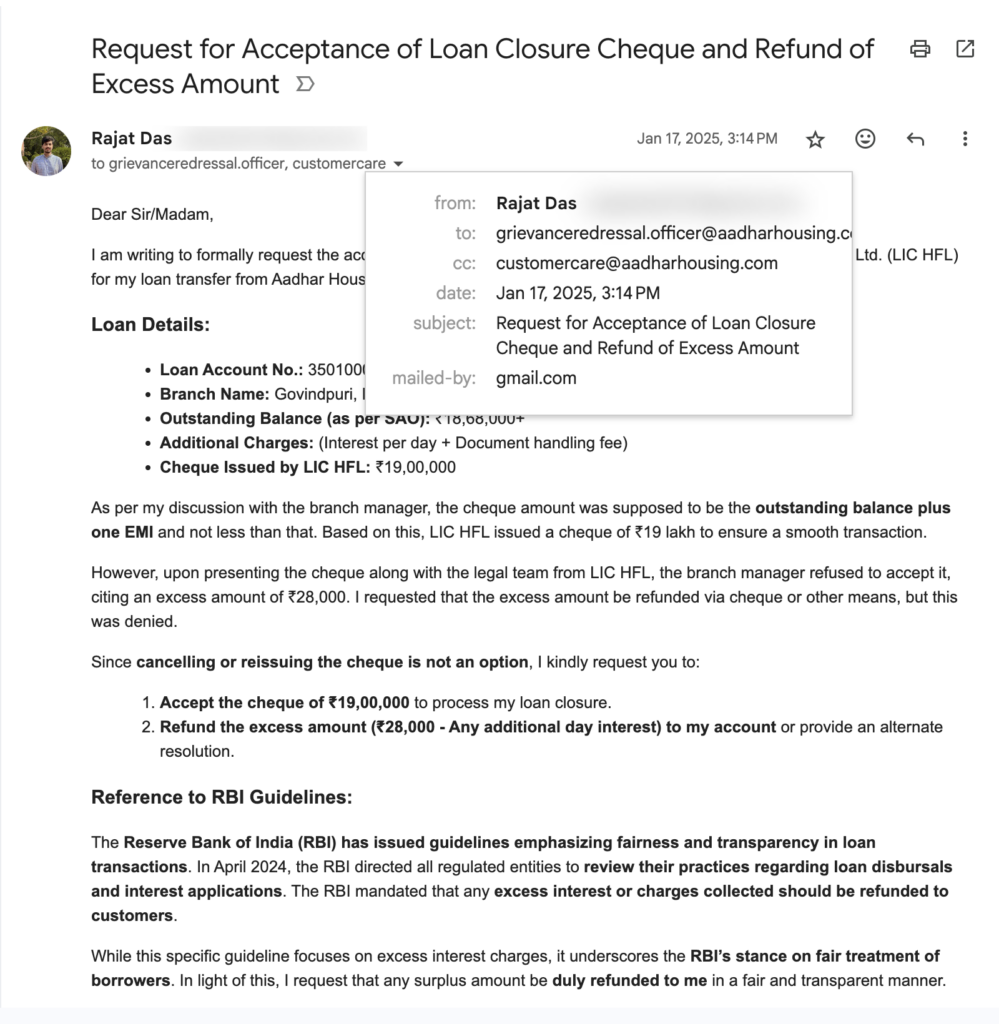

- Foreclosure Issues: When I attempted to submit my foreclosure cheque at the branch, they initially refused to accept it, citing that the amount was higher than required. When I requested a refund of the excess amount, they outright denied it. I had to escalate the matter and file a grievance before they finally accepted the cheque.

- Forced to Provide a Sanction Letter from the New Bank: When I decided to transfer my loan to another bank, AHFL forced me to provide a sanction letter from the new bank before they would proceed with the loan closure process. This added unnecessary delays and complications to an already frustrating experience.

Confusing and Misleading Document Collection Process

When it came time to collect my loan closure documents, I was informed over a telephonic call that I needed to bring only my Aadhar and PAN cards. Since the loan was in a joint account with my mother, I clarified this on the call, and they assured me that these documents were sufficient.

However, when I arrived at the branch, they suddenly required my mother to be physically present as well. This inconsistency caused unnecessary inconvenience and delay.

Automatic Policy Enrollment Without Consent

Perhaps one of the most shocking aspects of my experience was that AHFL automatically allotted me an insurance policy without informing me or seeking my consent. This forced inclusion not only added unexpected costs but also raised serious ethical concerns about their business practices.

Final Thoughts

I regret choosing Aadhar Housing Finance Ltd for my home loan. The inefficiency at the branch, lack of clear communication, hidden charges, and forced services made my home loan experience stressful rather than seamless.

Also, the absence of online pre-payment options made repayments unnecessarily inconvenient. If you’re considering taking a home loan from AHFL, I strongly urge you to weigh your options and be prepared for unexpected hurdles.

Transparency and customer service should be top priorities when choosing a financial institution, and in my experience, AHFL fell short in both areas.

Would I recommend AHFL? Based on my journey, I’d advise looking at alternative lenders with better customer service, digital convenience, and transparent policies.